What is Digi Khata Money Transfer?

The Digi Khata Domestic Money Transfer service allows users to transfer money to any bank account in India. It is a convenient and secure way to send money, especially for those who may not have access to traditional banking services.

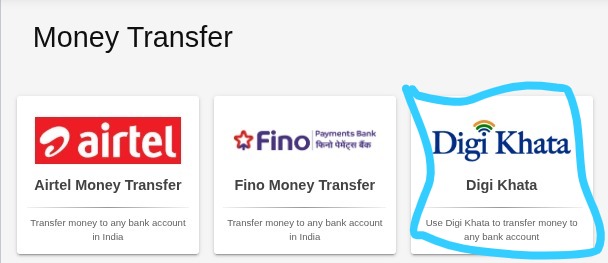

1. Start Digi Khata Money Transfer

Step 1: Select Digi Khata Money Transfer

- Click Money Transfer

- Select Digi Khata

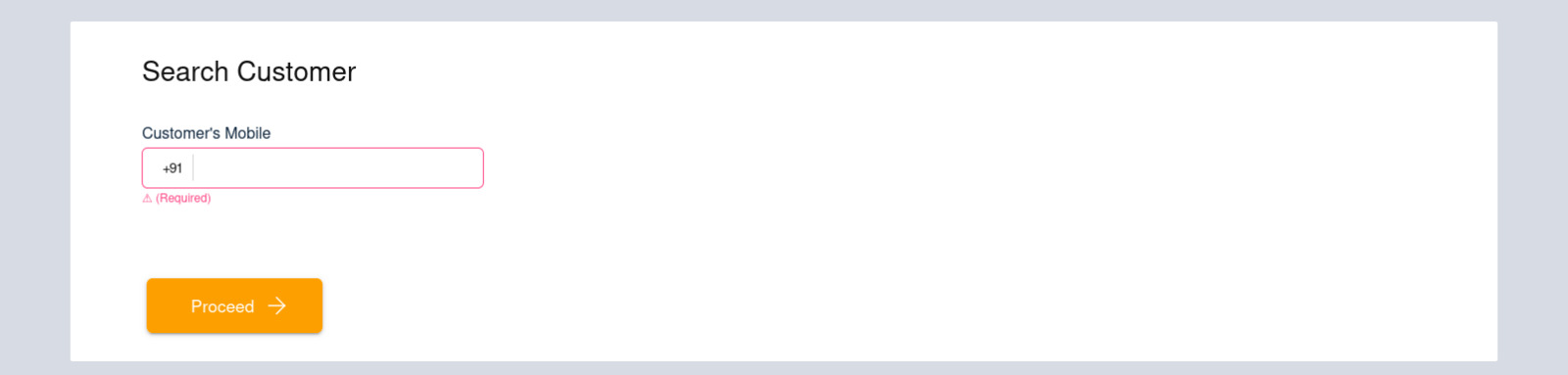

Step 2: Enter the Customer’s Mobile Number

- Type the customer’s 10-digit mobile number

- Click Proceed

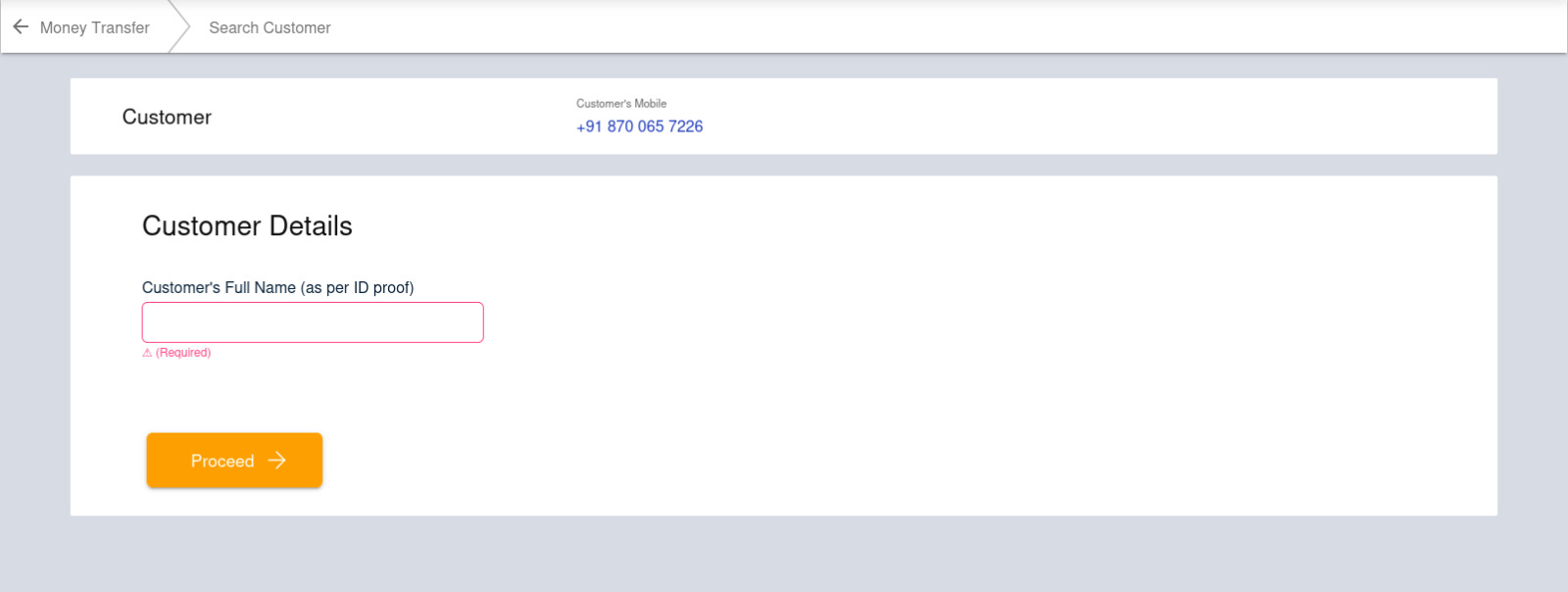

2. Register First Time Customer

Step 1: For first time customers, complete customer’s Details

- Input the customer’s Full Name (exactly as per Aadhaar)

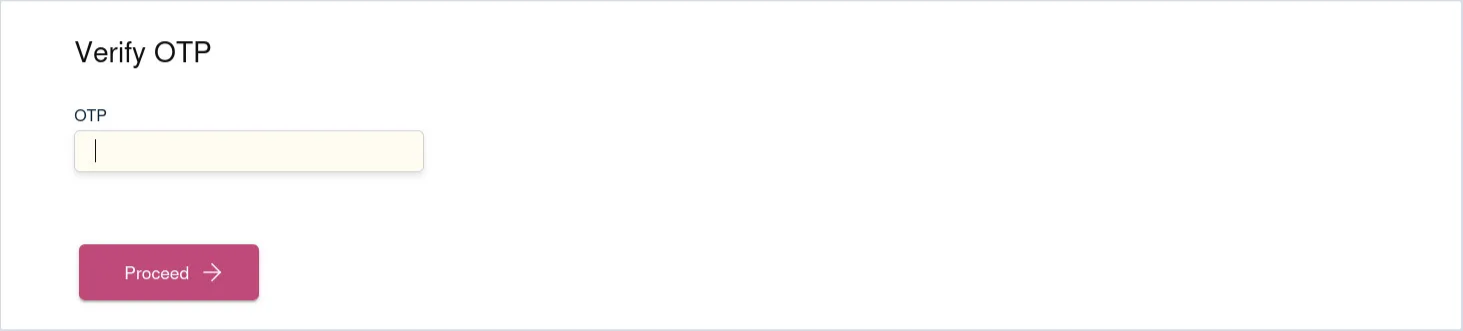

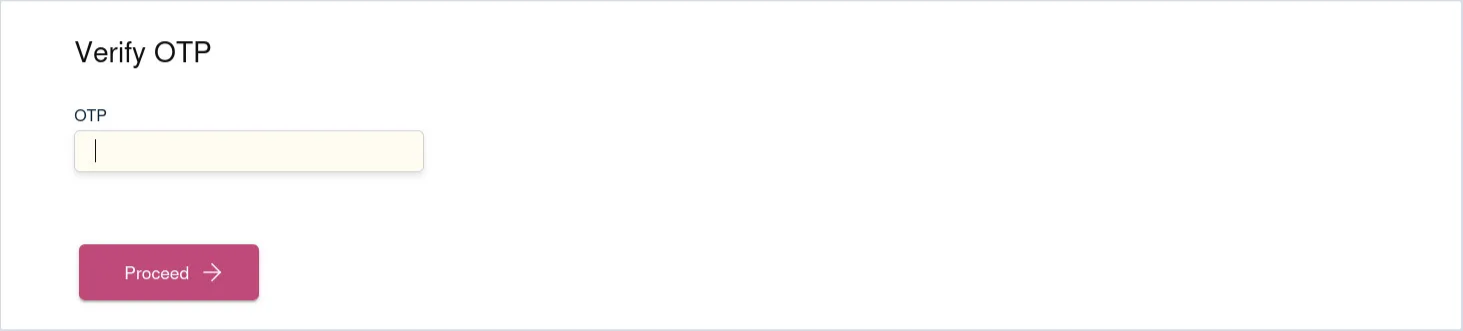

- Verify OTP received on customer’s mobile number

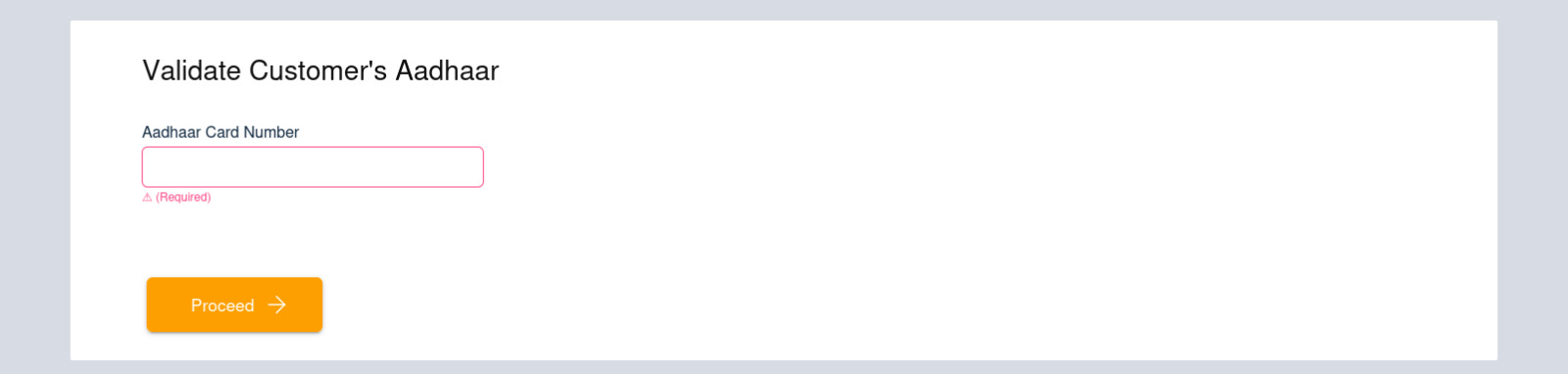

- Enter the 12-digit Aadhaar number of customer (no spaces or dashes)

- Enter the OTP received on customer’s number for Aadhaar verification

- Verify Customer’s PAN number by entering customer’s 10-digit PAN number (no spaces)

- Click Submit to complete registration

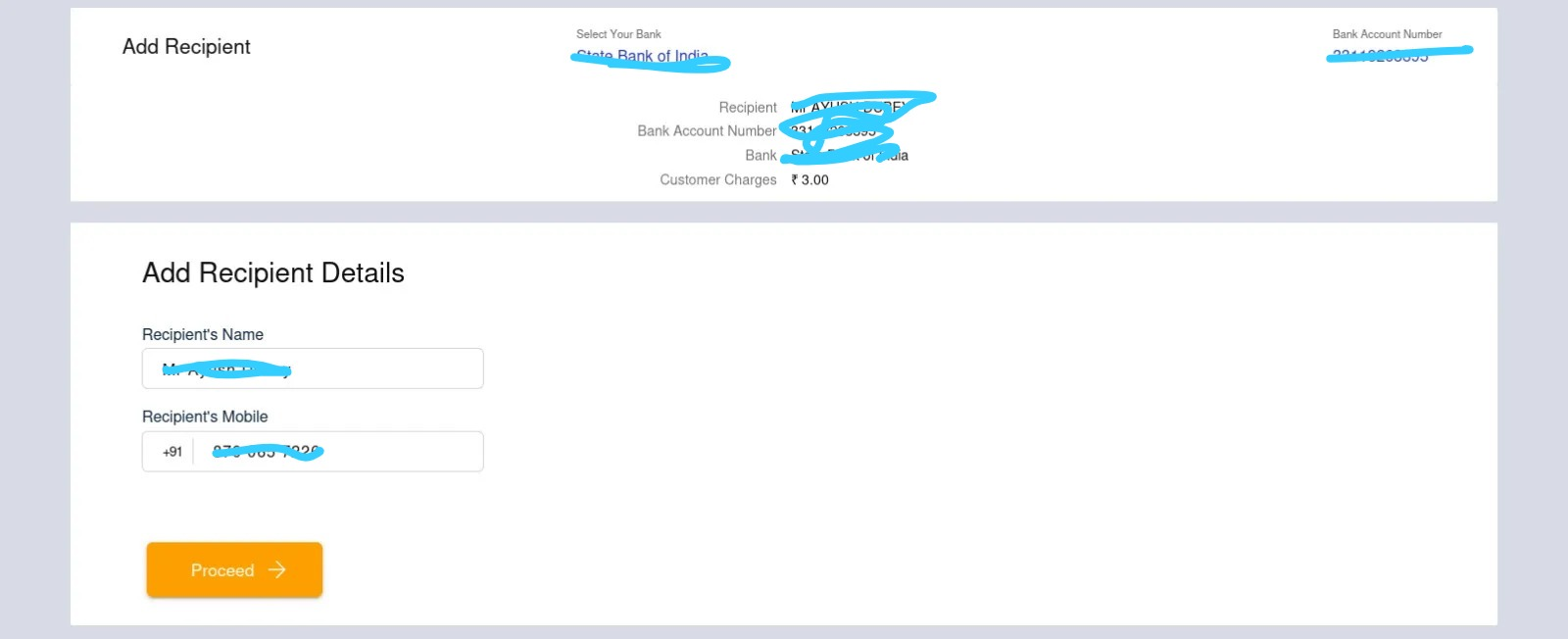

3. Add Recipient

Step 1: Add Recipient

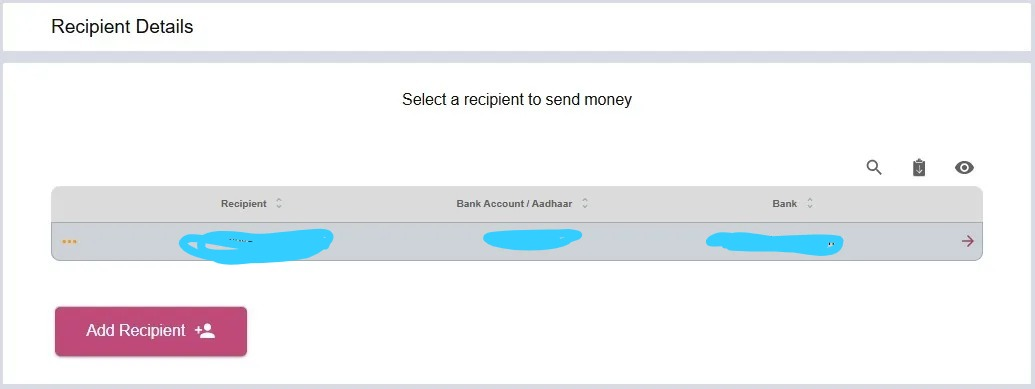

- Registered Customer should enter their mobile number and verify OTP

- Click Add Recipient on the transfer screen

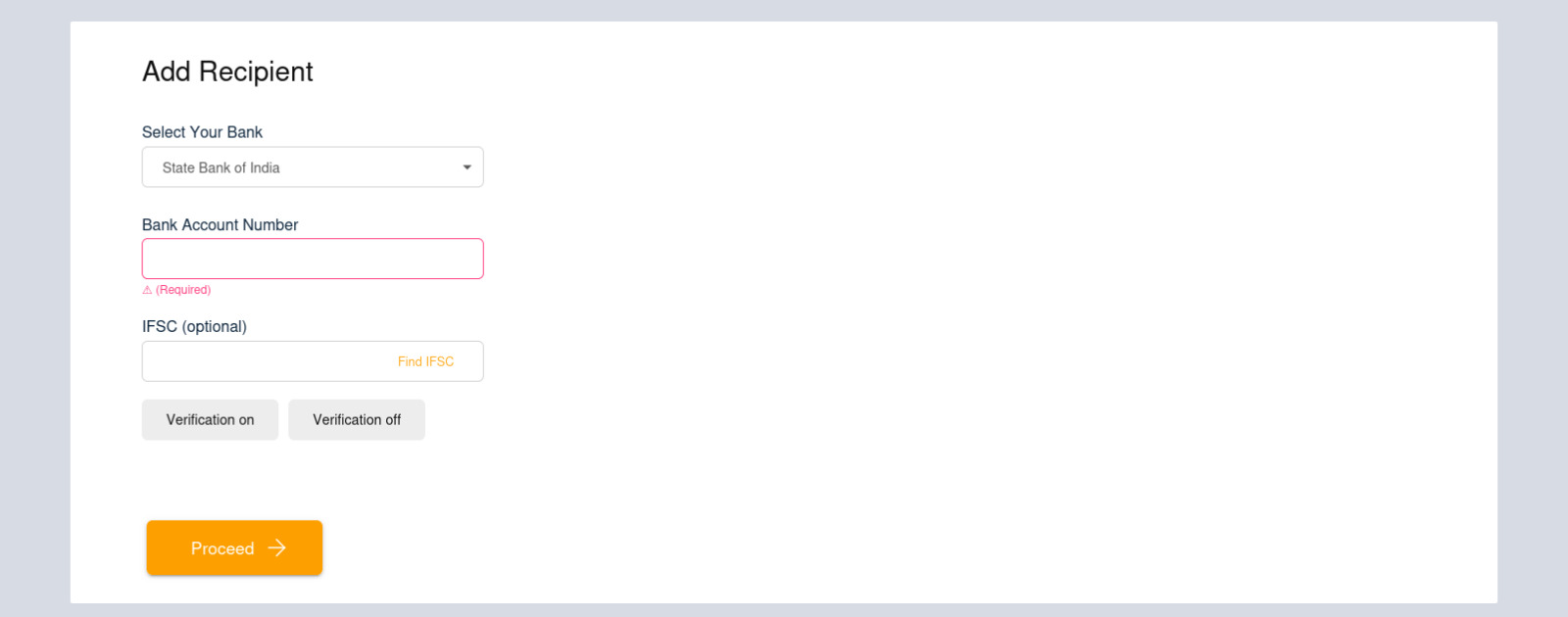

Step 2: Fill in Recipient Details

- Recipient’s Full Name (as per bank records)

- Bank Account Number (mandatory)

- IFSC Code (optional depending on customer’s bank policies.)

- Add recipient details (Name and Mobile number)

- Click Proceed to save

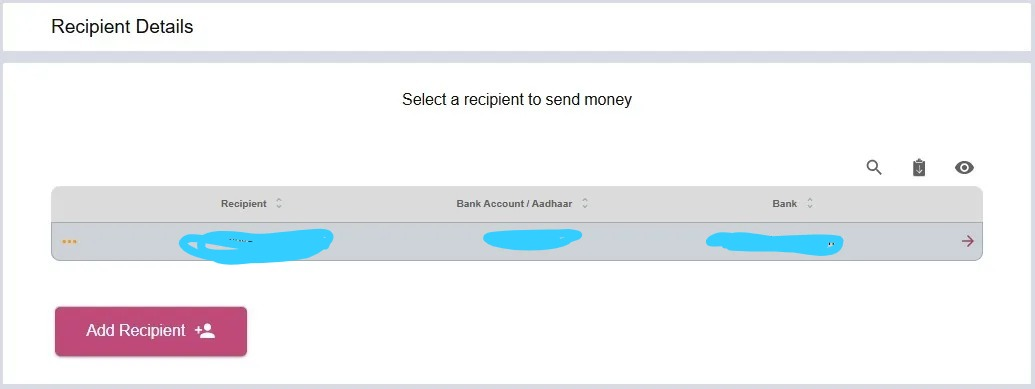

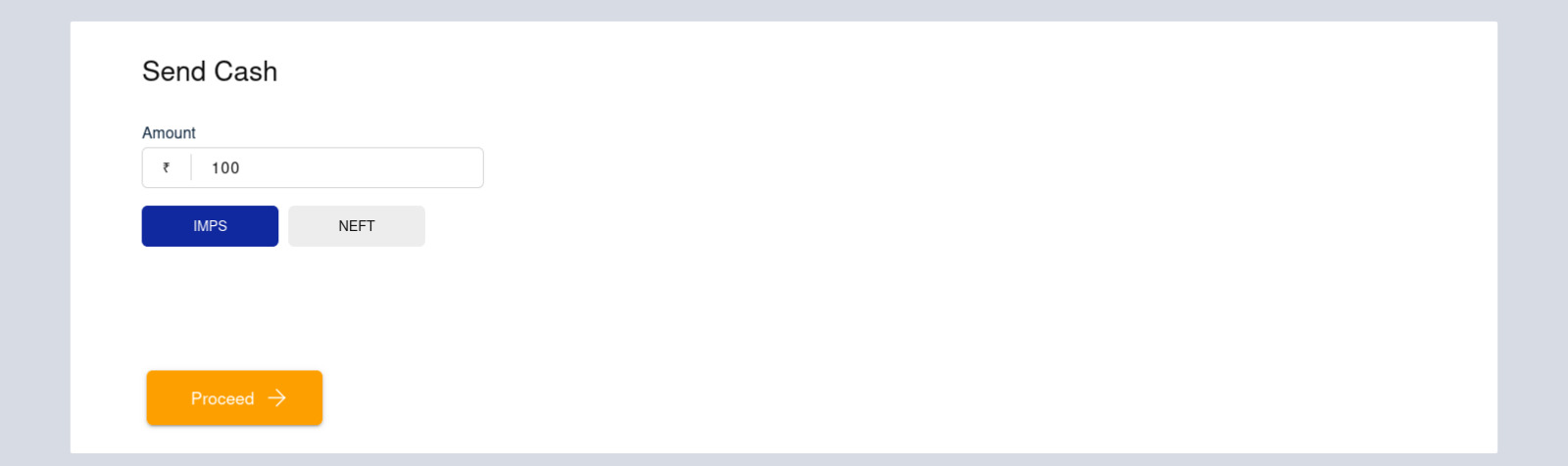

4. Transfer Money

Step 1: Enter Transfer Details

- Select the added recipient(s) from the list

- Enter the Amount to be transferred (e.g., 1000)

- Choose IMPS or NEFT

- If IMPS is available, select it for instant transfer.

- Click Proceed

Step 2: Final OTP Verification for Transaction

- Enter the new OTP received on the customer’s mobile number

- Enter the secret pin of the retailer

- Click on Proceed to finalize the transaction

Step 3: Transaction Confirmation

- Verify the receipt details (recipient name, account number, amount)

- Share the receipt with the customer

5. Key Points to Remember

- Ensure the customer’s mobile number entered is linked to the customer’s Aadhaar card and PAN card.

- An OTP is sent to the Aadhaar-registered mobile number after entering Aadhaar details.

- The individual whose Aadhaar details are provided must personally complete the biometric verification process.

- The maximum allowable transaction limit for Domestic Money Transfer transactions registered under a single mobile number with Digi Khata is ₹50,000 per month.

- For Digi Khata Money Transfer, customers may transfer up to ₹50,000 in a single transaction. This limit is defined by DigiKhata.

6. Error Messages and Their Explanation

- Error: “OTP already sent to 9346045046, please wait for minimum 1 minutes before requesting new OTP.”

- Explanation: OTP has already been generated. Please wait at least 1 minute before requesting another to avoid being blocked.

- Error: “OTP attempts exhausted. Please try again after 15 min.”

- Explanation: Maximum OTP attempts have been reached. You must wait for 15 minutes before trying again.

- Error: “Sorry! Customer number is not allowed to use Money Transfer service due to suspected…”

- Explanation: The customer’s number may have been flagged due to suspicious or unauthorized activity. Contact support for resolution.

- Error: “Sorry! Aadhaar number and biometric scan did not match. Please try again. Please clean device surface. Inform customer to clean hands or try different finger.”

- Explanation: Biometric verification failed. Clean the device scanner and the customer’s finger, or use a different finger for scanning.

- Error: “Sorry! Customer registration has failed as DOB must be 18 years older and less than 100.”

- Explanation: Registration failed due to invalid age. The customer must be between 18 and 100 years old.