What are the Vehicle Insurance Services provided by Harita?

-

Harita Insurance provides comprehensive private car and two wheeler (bike) insurance policies for the owner-driver within their vehicle insurance services.

-

Policies can be enhanced with optional add-ons like Zero Depreciation, Roadside Assistance, Engine Protector, and Return to Invoice, allowing you to customize coverage to your specific needs.

How to proceed to Harita Vehicle Insurance Page?

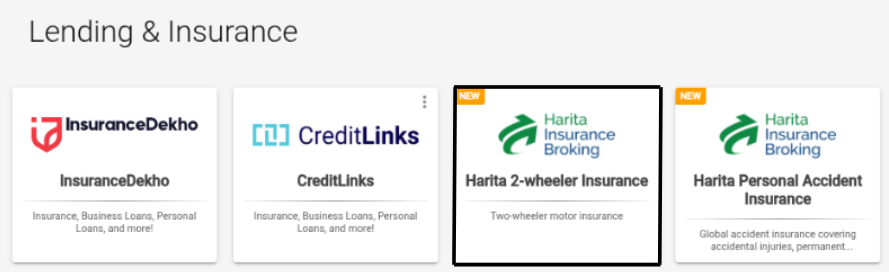

Step 1: Go to Lending & Insurance Section

Navigate to Lending & Insurance section in the side menu within the portal. Then, click on Harita 2-wheeler Insurance option.

Step 2: Register Email (One-Time Only)

You must update your email address, if you have not provided it before on this app.

Step 3: Go to Harita Vehice Insurance Page

Click on “Buy Insurance” option to navigate to the Harita Vehicle Insurance page.

How to Buy Two Wheeler (Bike) Insurance?

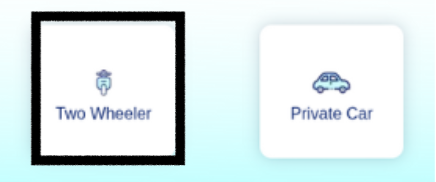

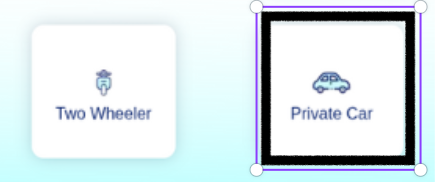

Step 1: Select Two Wheeler Option

Start Booking Bike Insurance by selecting the “Two Wheeler” option

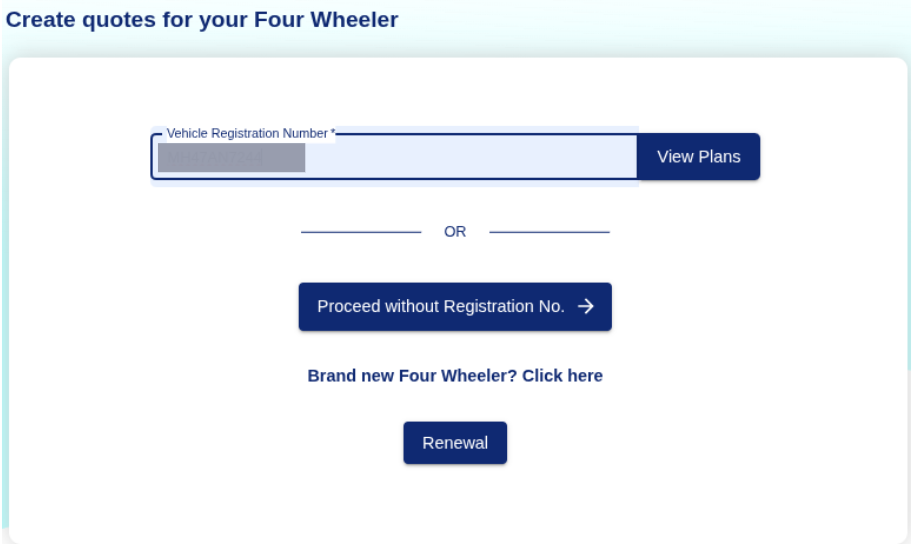

Step 2: Enter Bike Registration Number

Start by entering the Vehicle Registration Number and click on View Plans.

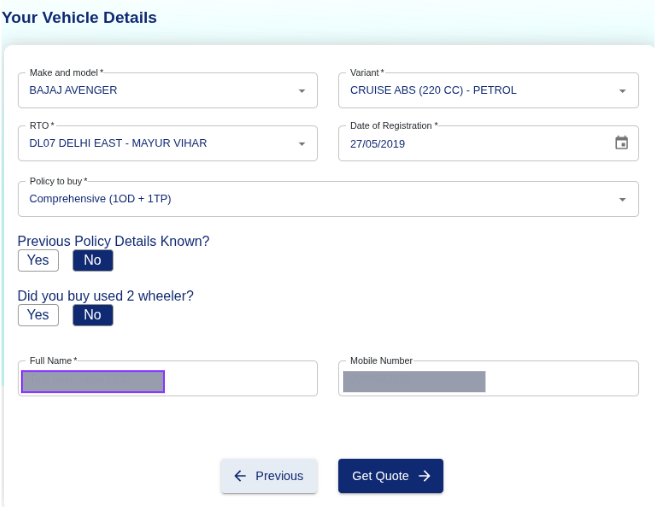

Step 3: Enter Bike Details

- Fill out the following fields:

- Make and model of the bike

- Variant of the vehicle

- RTO Location

- Date of Registration

- Policy Type: Choose between Comprehensive (1OD + 1TP) or other options

- Previous Policy Details Known? Yes / No

- Is it a used vehicle? Yes / No

- Full Name

- Mobile Number

- Click on Get Quote.

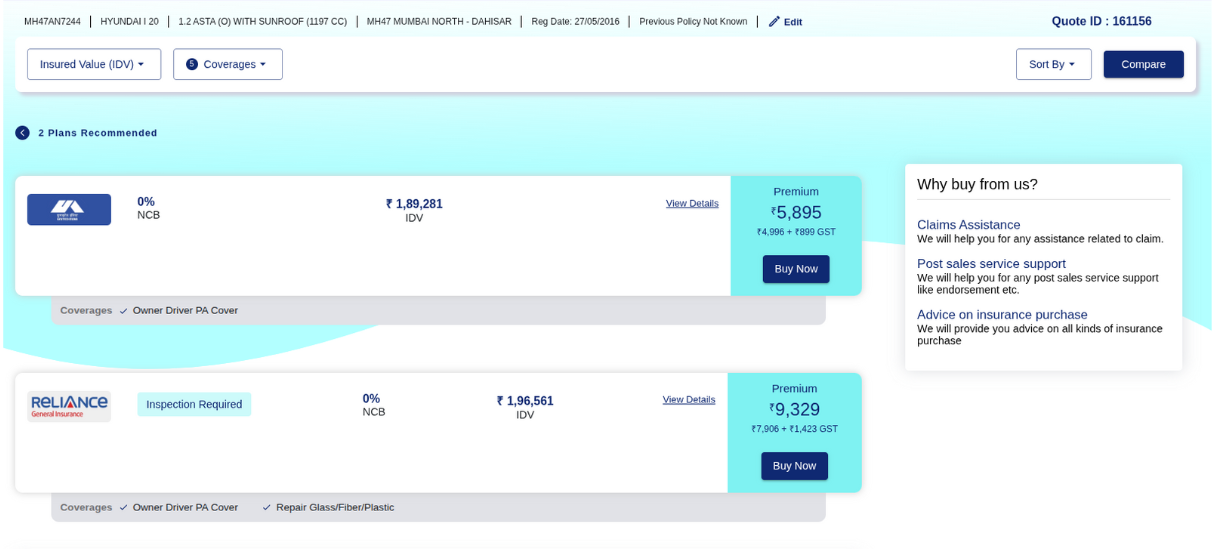

Step 4: View Available Policy Plans

Compare the available policy plans shown based on your vehicle details. Choose one of the plans by clicking the “Buy Now” button.

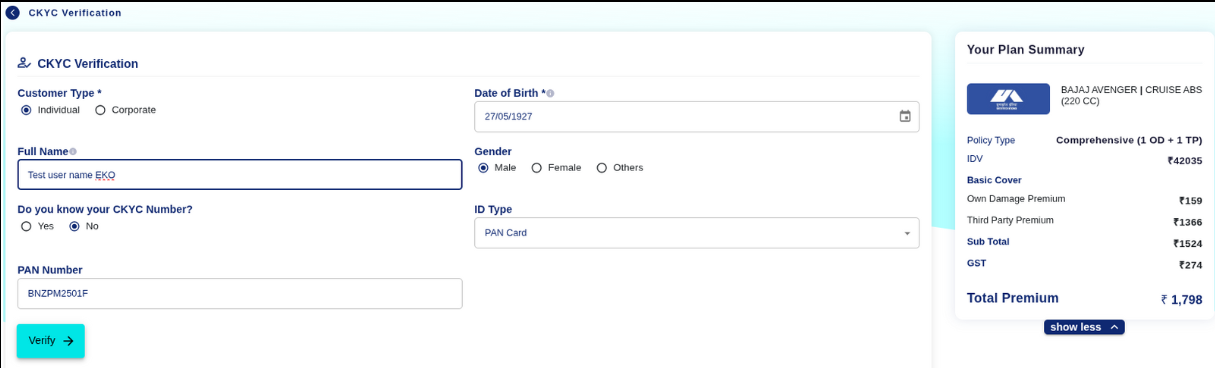

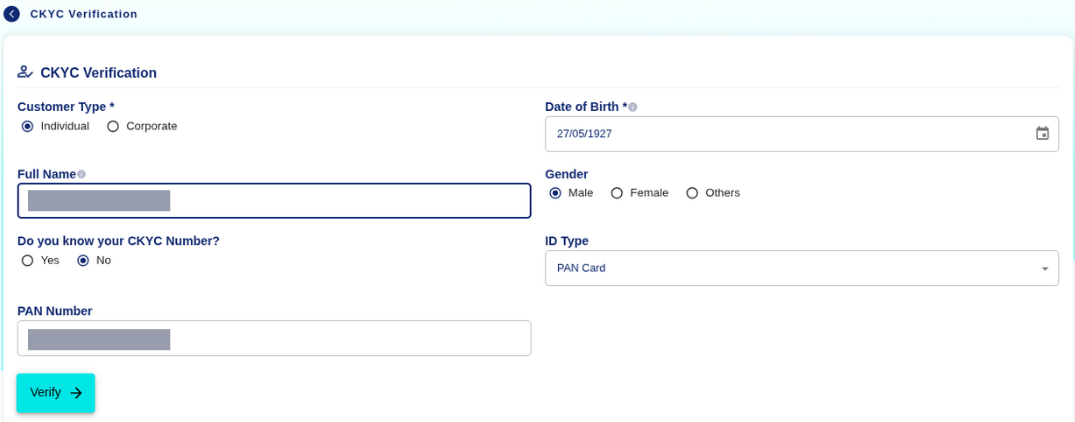

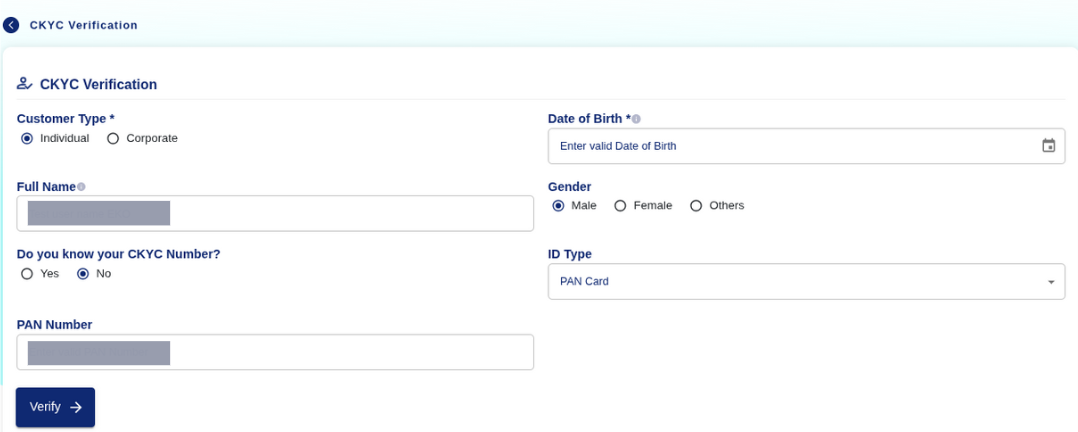

Step 5: Complete CKYC Verification and Review Plan Summary

- Fill in the CKYC verification form:

- Customer Type: Select Individual or Corporate

- Full Name

- PAN Number

- Date of Birth

- Gender

- ID Type: Select from dropdown

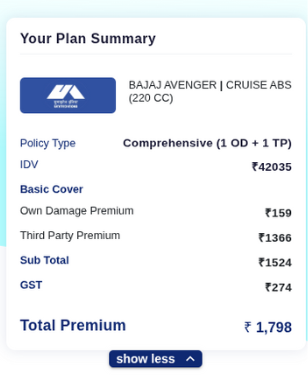

- Review Plan Summary

Confirm these details and make sure all details are accurate before moving forward:

- Policy Type

- Basic Cover Breakdown

- Add-On Covers

- Total Premium

Step 6: Complete Payment

Proceed to payment using available online payment options to finalize and purchase the policy.

How to Buy Private Car Insurance?

Step 1: Select Private Car Option

Start Booking Car Insurance by selecting the “Private Car” option.

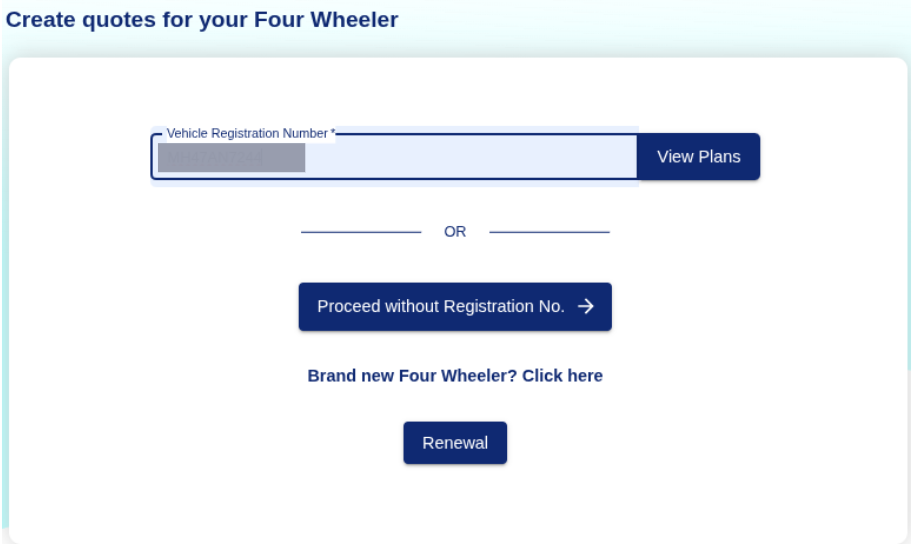

Step 2: Enter Car Registration Number

Start by entering the Vehicle Registration Number and click on View Plans.

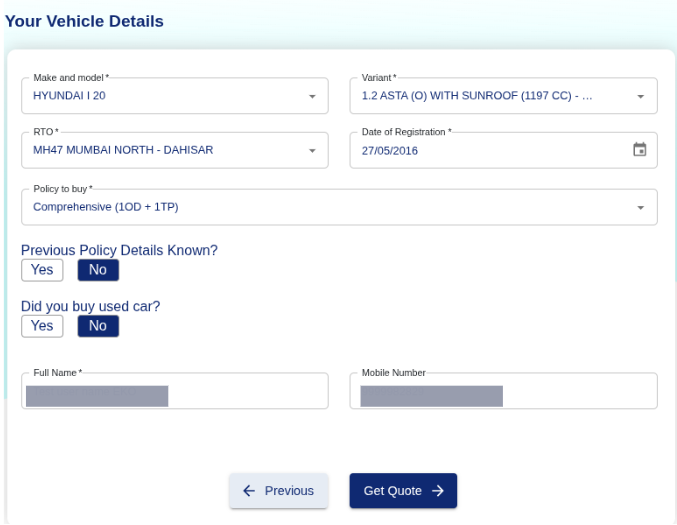

Step 3: Enter Car Details

- Fill out the following fields:

- Make and model of the car

- Variant of the vehicle

- RTO Location

- Date of Registration

- Policy Type: Choose between Comprehensive (1OD + 1TP) or other options

- Previous Policy Details Known? Yes / No

- Is it a used vehicle? Yes / No

- Full Name

- Mobile Number

- Click on Get Quote.

Step 4: View Available Policy Plans

Compare the available policy plans shown based on your vehicle details. Choose one of the plans by clicking the “Buy Now” button.

Step 5: Complete CKYC Verification and Review Plan Summary

- Fill in the CKYC verification form:

- Customer Type: Select Individual or Corporate

- Full Name

- PAN Number

- Date of Birth

- Gender

- ID Type: Select from dropdown

- Review Plan Summary

Confirm these details and make sure all details are accurate before moving forward:

- Policy Type

- Basic Cover Breakdown

- Add-On Covers

- Total Premium

Step 6: Complete Payment

Proceed to payment using available online payment options to finalize and purchase the policy.

Key Points to Remember

- Ensure correct registration number to get accurate quotes.

- Always verify CKYC details before submission.

- Review IDV and coverage options before making payment.

- Keep a screenshot or PDF of the quote or policy for future reference.